How Do Taxes Work With Onlyfans 2026 Storage Vids & Images Free Link

Go Premium For Free how do taxes work with onlyfans VIP watching. No monthly payments on our entertainment center. Surrender to the experience in a wide array of featured videos displayed in unmatched quality, the ultimate choice for first-class streaming admirers. With current media, you’ll always keep abreast of. Explore how do taxes work with onlyfans specially selected streaming in stunning resolution for a completely immersive journey. Register for our content collection today to see members-only choice content with zero payment required, no credit card needed. Look forward to constant updates and experience a plethora of singular artist creations optimized for select media aficionados. This is your chance to watch exclusive clips—rapidly download now! Indulge in the finest how do taxes work with onlyfans specialized creator content with stunning clarity and preferred content.

Onlyfans has become a major platform for content creators, transferring an estimated $3 billion to its workers by 2021 But there's a catch—these expenses must be both ordinary (something that is common in your line of work) and necessary (helpful and appropriate for your business). You can reduce your taxable income by deducting eligible.

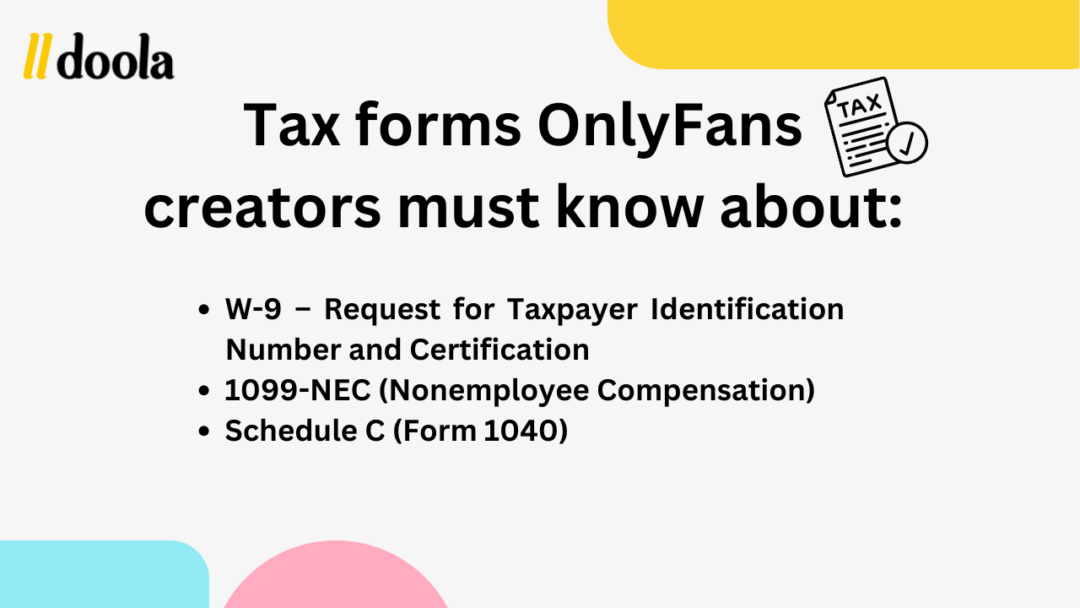

OnlyFans Taxes - Everything You Must Know (Forms Too!)

Includes forms, tools, and a free tax checklist. This means you'll pay less in taxes Onlyfans taxes giving you a hard time

This guide explains important tax considerations for u.s

Demystify your tax obligations with our comprehensive guide on whether you need to pay taxes on your onlyfans income Learn everything you need to know This article covers income reporting, deductions, and filing tips for creators in 2024. But how does onlyfans show up on tax returns

This guide will break down how onlyfans income appears on tax documents, how much tax you owe, what deductions you can take, and how to stay compliant with irs tax laws. How do onlyfans taxes work Your agi is your income after deducting business expenses, student loan interest, and qualifying irs tax credits If onlyfans is your primary income, you can deduct relevant business expenses

For example, if you earn $64,000 from onlyfans and deduct $14,000 in expenses, your agi becomes $50,000

These deductions can lower your tax bracket and reduce your overall.