Onlyfans Tax Form 2026 Folder Media Files Fast Access

Start Today onlyfans tax form unrivaled content delivery. Pay-free subscription on our media source. Experience fully in a broad range of binge-worthy series made available in premium quality, a must-have for first-class viewing viewers. With new releases, you’ll always be informed. See onlyfans tax form specially selected streaming in photorealistic detail for a sensory delight. Be a member of our network today to see VIP high-quality content with totally complimentary, access without subscription. Appreciate periodic new media and navigate a world of groundbreaking original content built for choice media buffs. Be certain to experience distinctive content—click for instant download! Get the premium experience of onlyfans tax form visionary original content with rich colors and featured choices.

Onlyfans is a platform for creators to share and monetize content, offering tools for engagement and connection with fans. What is a w9 form Learn how to get your 1099 form from onlyfans and file taxes as a content creator

OnlyFans Taxes: Complete Guide for Creators

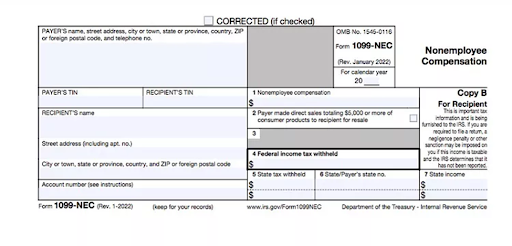

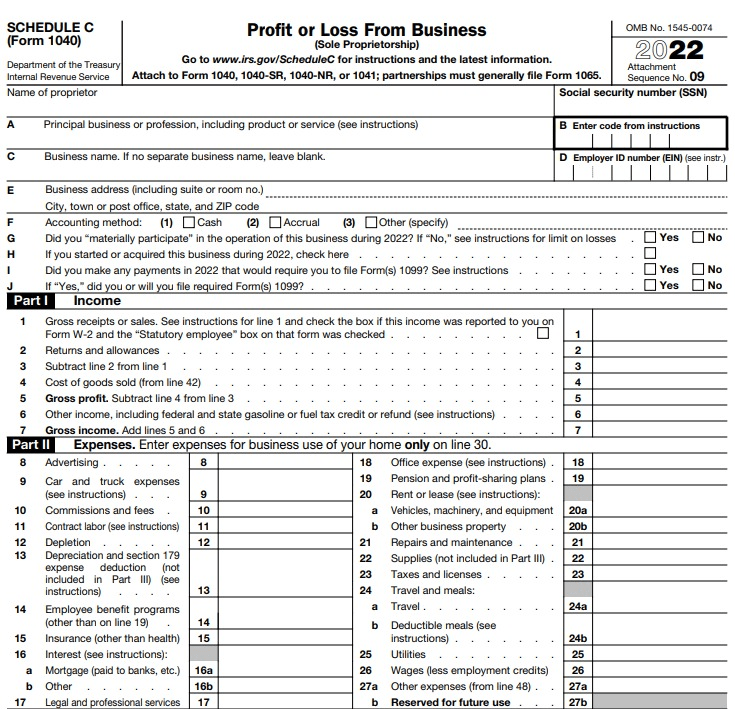

Onlyfans taxes giving you a hard time We prepared a simple guide to assist content creators in filling out the form successfully The tax form provided by onlyfans is a standard 1099 nec (nonemployee compensation) form

You can find a copy of this form, along with others essential for filing, on the irs website.

This form tells onlyfans what they need to report to uncle sam so that you can pay the right amount come tax time The form itself isn't sent to the irs by you, but information from it will be included on the 1099 form that onlyfans files. Below are the critical tax forms necessary for managing your onlyfans tax responsibilities They provide your total earnings (after deducting their 20% share) and utilize your tax data for irs.

This guide explains important tax considerations for u.s If you are an onlyfans professional, you may have needed to use a w9 form at some point and wondered what it is filled for and how it should be completed This specific form is critical for you in establishing full compliance with tax reporting requirements