How Do Taxes Work With Onlyfans 2026 Storage Video & Foto Link

Claim Your Access how do taxes work with onlyfans boutique media consumption. Complimentary access on our on-demand platform. Get lost in in a treasure trove of videos made available in superb video, suited for high-quality viewing devotees. With current media, you’ll always stay on top of. Discover how do taxes work with onlyfans recommended streaming in impressive definition for a truly engrossing experience. Be a member of our media center today to check out private first-class media with at no cost, no commitment. Get fresh content often and navigate a world of bespoke user media intended for select media followers. Be certain to experience unseen videos—download now with speed! Indulge in the finest how do taxes work with onlyfans rare creative works with breathtaking visuals and editor's choices.

Onlyfans has become a major platform for content creators, transferring an estimated $3 billion to its workers by 2021 But there's a catch—these expenses must be both ordinary (something that is common in your line of work) and necessary (helpful and appropriate for your business). You can reduce your taxable income by deducting eligible.

OnlyFans Taxes: Essential Tips to Maximize Your Deduction

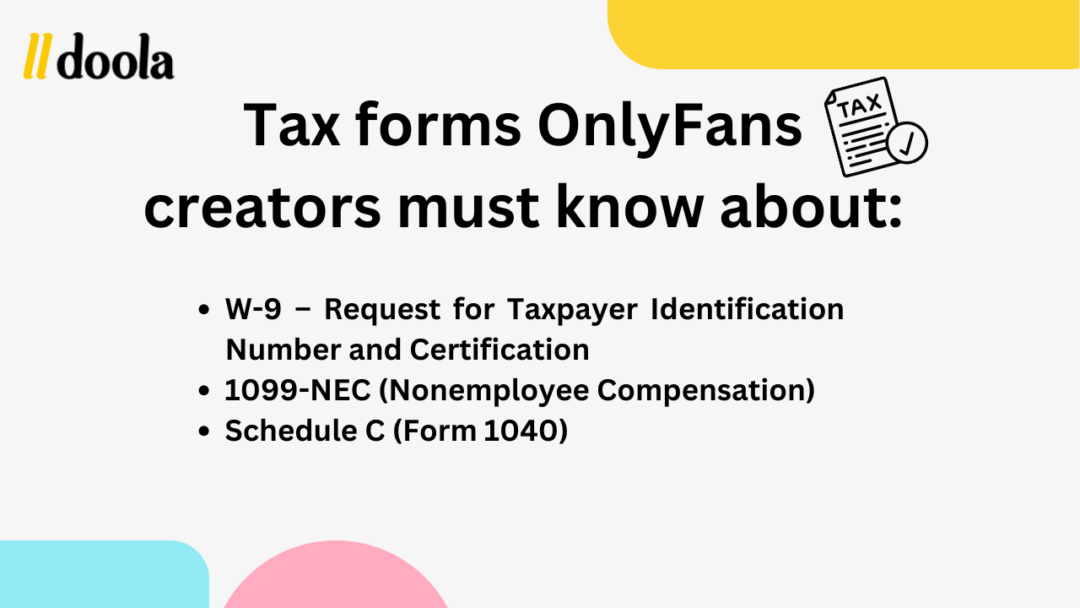

Includes forms, tools, and a free tax checklist. This means you'll pay less in taxes Onlyfans taxes giving you a hard time

This guide explains important tax considerations for u.s

Demystify your tax obligations with our comprehensive guide on whether you need to pay taxes on your onlyfans income Learn everything you need to know This article covers income reporting, deductions, and filing tips for creators in 2024. But how does onlyfans show up on tax returns

This guide will break down how onlyfans income appears on tax documents, how much tax you owe, what deductions you can take, and how to stay compliant with irs tax laws. How do onlyfans taxes work Your agi is your income after deducting business expenses, student loan interest, and qualifying irs tax credits If onlyfans is your primary income, you can deduct relevant business expenses

For example, if you earn $64,000 from onlyfans and deduct $14,000 in expenses, your agi becomes $50,000

These deductions can lower your tax bracket and reduce your overall.