2020 Xxl Freshman 2026 Folder Video/Photo Download

Gain Access 2020 xxl freshman VIP playback. Zero subscription charges on our viewing hub. Experience fully in a boundless collection of series unveiled in high definition, optimal for first-class watching gurus. With hot new media, you’ll always get the latest. Seek out 2020 xxl freshman organized streaming in life-like picture quality for a sensory delight. Connect with our entertainment hub today to enjoy select high-quality media with 100% free, no credit card needed. Benefit from continuous additions and journey through a landscape of singular artist creations optimized for deluxe media experts. Don't forget to get distinctive content—begin instant download! See the very best from 2020 xxl freshman rare creative works with lifelike detail and curated lists.

Now even easier, with valore Accounts receivable, nike, incorporated, is a leading manufacturer of sports apparel, shoes, and equipment. We've teamed up with valore.com to bring you more affordable options for college textbooks

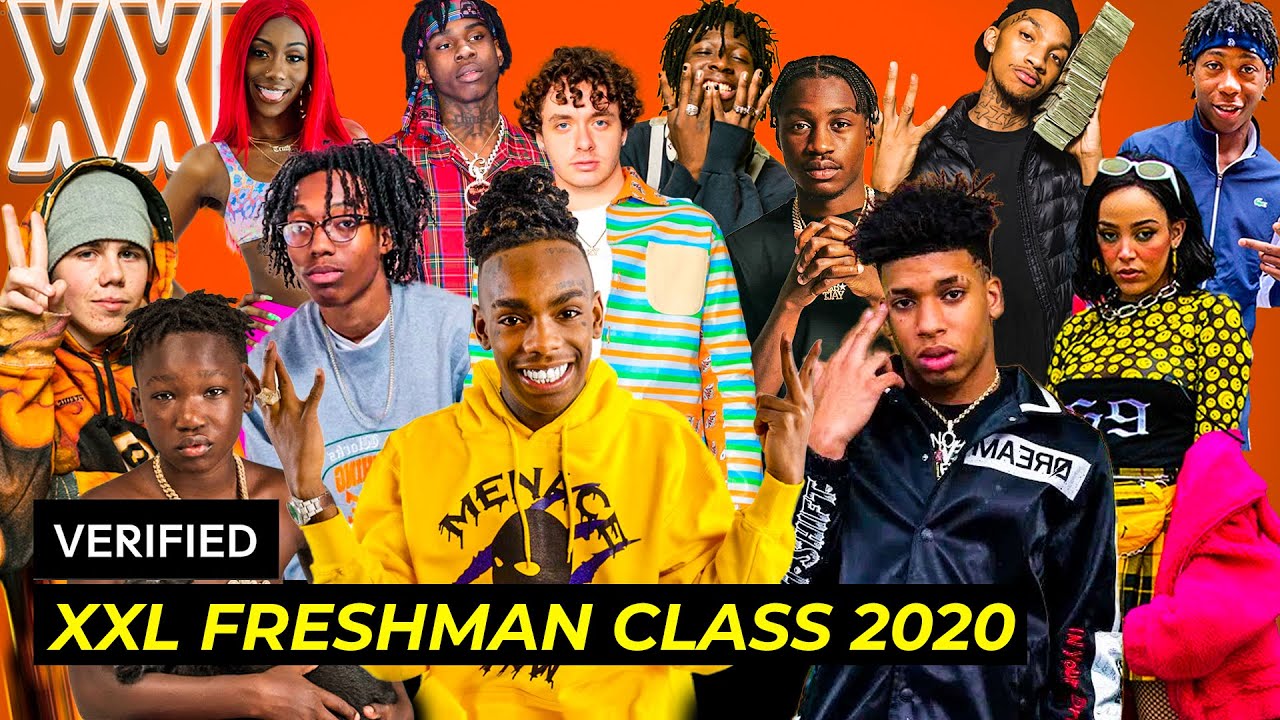

XXL 2020 Freshman Class Revealed | The Beat 107.3

Whether you're looking to buy textbooks online, rent textbooks for the semester, or sell textbooks you no longer need, valore offers competitive prices and a seamless experience The company’s 2020 financial statements contain the following information ($ in millions) Finding cheap textbooks has never been easier, get the course materials you need to succeed.

On december 31, 2020, extreme fitness has adjusted balances of $800,000 in accounts receivable and $55,000 in allowance for doubtful accounts

Minta corporation, is a leading manufacturer of sports apparel, shoes, and equipment The company's 2020 financial statements contain the following information (\$ in millions) Assume that all sales are made on a credit basis What is the amount of gross (total) accounts receivable due from customers at the end of 2020 and 2019

At december 31, 2020, besler corporation had a projected benefit obligation of $560,000, plan assets of $322,000, and prior service cost of $127,000 in accumulated other comprehensive income Determine the pension asset/liability at december 31, 2020. On january 1, 2020, parent company acquired 70 percent of the outstanding voting stock of subsidiary, inc., for a total of $805,000 in cash and other consideration. On march 25,2020 , barr returned 7 tool sets and received a credit to its account

(a) your answer is correct

Prepare journal entries for crane to record (1) the sale on march 10, 2020, (2) the return on march 25, 2020, and (3) any adjusting entries required on march 31, 2020 (when crane prepares financial statements). For each of the three